One of the key features of trading with IC Markets is its flexible IC Markets leverage options, which can amplify the potential returns on your trades. In this article, we'll take a closer look at what leverage is, how it works at IC Markets, and some of the key considerations to keep in mind when trading with leverage.

What is Leverage?

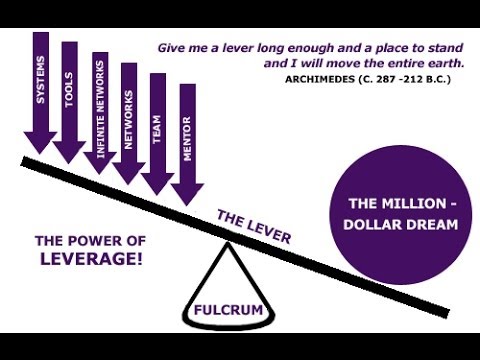

Leverage is a trading mechanism that enables traders to open larger positions in the market than they would otherwise be able to with their available funds. Essentially, leverage is like borrowing money from the broker to trade with, allowing traders to amplify their potential profits (and losses) on a given trade. The amount of leverage available to traders varies depending on the broker and the trading instrument, but can range from 1:1 to as high as 1000:1.

How Does Leverage Work at IC Markets?

IC Markets offers its clients flexible leverage options, depending on the trading instrument and the account type. The broker's maximum leverage is 500:1, which is available on forex pairs, metals, and indices. Cryptocurrency trading carries a lower leverage of up to 200:1. For share CFDs, IC Markets offers a maximum leverage of 20:1. It's important to note that leverage can vary depending on the specific instrument and market conditions, so it's always a good idea to check the leverage offered on a particular trade before placing it.

What are the Benefits of Using Leverage?

Using leverage can offer a number of benefits for traders. Firstly, it can enable traders to open larger positions in the market with a smaller deposit, which can increase the potential returns on a given trade. Secondly, leverage can allow traders to diversify their trading strategies and access a wider range of trading instruments than they would otherwise be able to with their available funds. Finally, leverage can be a useful tool for hedging against potential losses in the market.

What are the Risks of Using Leverage?

While leverage can offer potential benefits for traders, it's important to keep in mind that it also carries significant risks. One of the main risks of using leverage is the potential for amplified losses. If a trade moves against you, the losses can be magnified by the leverage used, which can result in significant losses that exceed your initial deposit. It's also important to note that leverage can increase the volatility of your trading account, making it more susceptible to margin calls and unexpected market movements.

What Should I Consider When Trading with Leverage?

If you're considering trading with leverage at IC Markets, there are a number of key considerations to keep in mind. Firstly, it's important to carefully consider your risk tolerance and ensure that you only use leverage that you're comfortable with. Secondly, it's a good idea to have a solid trading plan in place, including stop-loss orders and other risk management strategies. Finally, it's important to regularly monitor your trading account and adjust your leverage settings as needed based on changing market conditions.

Final thought

In conclusion, leverage can be a powerful tool for amplifying the potential returns on your trades, but it also carries significant risks. If you're considering trading with leverage at IC Markets, it's important to carefully weigh the potential benefits and risks, and to ensure that you have a solid trading plan in place. With careful consideration and risk management, leverage can be a useful tool for enhancing your trading strategies and reaching your financial goals.